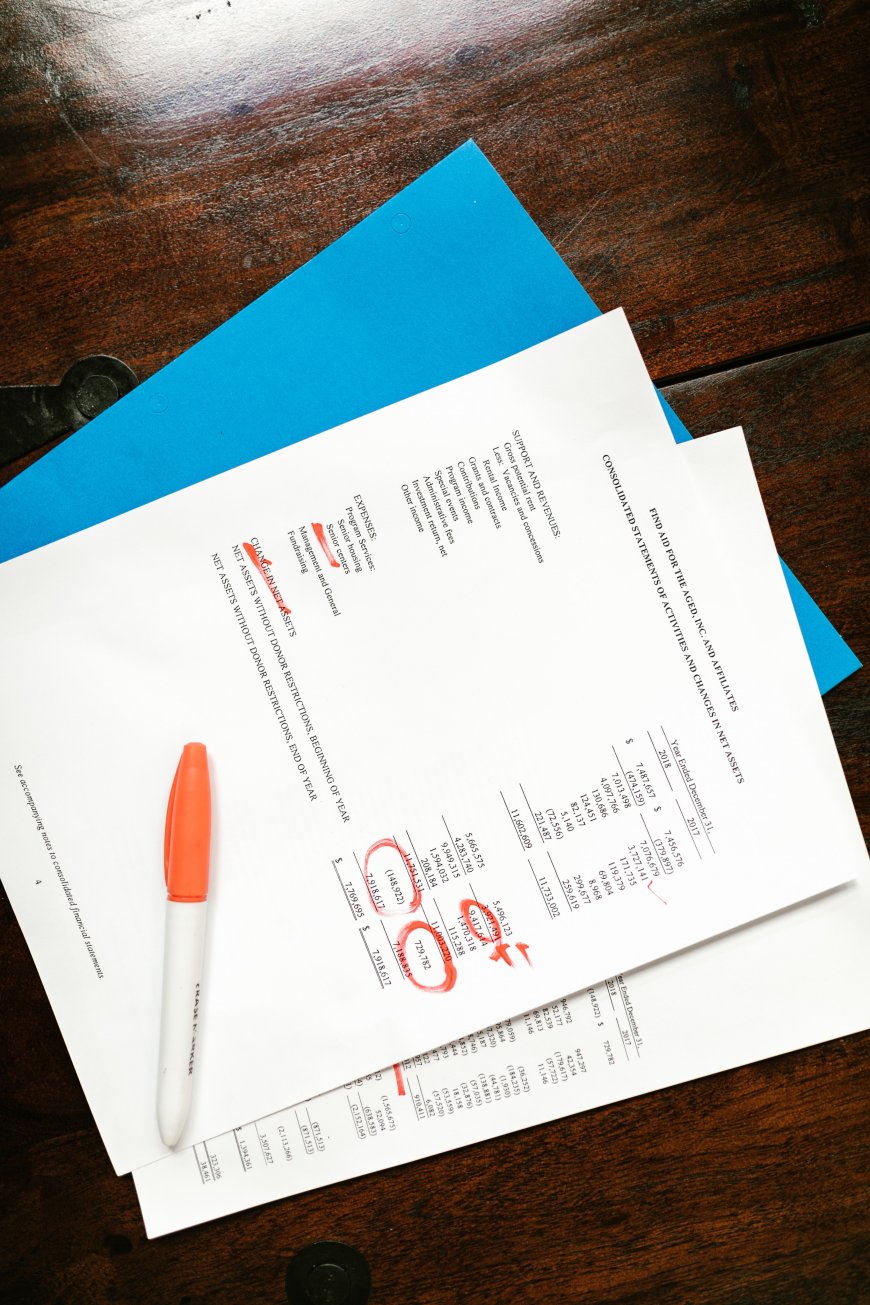

Profit and Loss (P&L) statement

A profit and loss (P&L) statement is a financial statement that summarizes a company's revenues and expenses over a period of time. It is one of the three main financial statements, along with the balance sheet and the cash flow statement.

The P&L statement is used to calculate a company's net income, which is the difference between its revenues and expenses. Net income is an important measure of a company's profitability.

The P&L statement is divided into two main sections:

- Revenues: This section lists all of the income that the company generated during the period. Revenues can come from a variety of sources, such as sales of goods or services, interest income, and rent income.

- Expenses: This section lists all of the costs that the company incurred during the period. Expenses can be divided into operating expenses and non-operating expenses. Operating expenses are the costs that are directly related to the company's business, such as cost of goods sold, selling expenses, and administrative expenses. Non-operating expenses are the costs that are not directly related to the company's business, such as interest expense and income tax expense.

The net income is calculated by subtracting the total expenses from the total revenues. If the total revenues are greater than the total expenses, the company will have a net income. If the total expenses are greater than the total revenues, the company will have a net loss.

The P&L statement is a valuable tool for investors and creditors. Investors use the P&L statement to assess a company's profitability and to make investment decisions. Creditors use the P&L statement to assess a company's ability to repay its debts.

Here are some of the key things to look for when analyzing a P&L statement:

- Revenue growth: Revenue growth is a good indicator of a company's future profitability. A company that is growing its revenue is more likely to be profitable in the future.

- Gross profit margin: The gross profit margin is a measure of a company's profitability from its core operations. A high gross profit margin indicates that the company is generating a lot of profit from its sales.

- Operating profit margin: The operating profit margin is a measure of a company's profitability after taking into account its operating expenses. A high operating profit margin indicates that the company is generating a lot of profit from its core operations after taking into account its operating expenses.

- Net profit margin: The net profit margin is a measure of a company's overall profitability. A high net profit margin indicates that the company is generating a lot of profit after taking into account all of its expenses.

By analyzing the P&L statement, investors and creditors can get a better understanding of a company's profitability and its ability to generate cash flow. This information can be used to make investment and lending decisions.

What's Your Reaction?